NESFB Net Banking Unleashed: Your Gateway to Effortless Digital Finance

Introduction to NESFB Net Banking

North East Small Finance Bank (NESFB), a prominent banking institution in India, has made significant strides in offering digital banking solutions. Their net banking service is a primary example of this advancement, providing customers with easy, secure, and efficient access to their financial services.

The Evolution of NESFB’s Digital Services

NESFB’s journey towards digitalization mirrors the broader trend in the banking sector. The adoption of net banking represents a crucial step in providing customer-centric, accessible banking solutions.

Key Features of NESFB Net Banking

Net banking services offered by NESFB include a range of features designed to meet the diverse needs of its customers. These features include online fund transfers, balance checks, statement downloads, and bill payments.

Enrolling in NESFB Net Banking

To take advantage of NESFB’s net banking services, customers must first enroll. The process is user-friendly and secure, ensuring customers can start utilizing the services quickly.

Steps to Register for Net Banking

- Visit the official NESFB website.

- Locate the net banking registration link.

- Fill in the required personal and account details.

- Set up a unique username and password.

Security Measures in Place

Security is a top priority for NESFB. The bank employs advanced encryption and multi-factor authentication to protect user data and transactions.

Understanding the Net Banking Interface

Net banking has revolutionized how we manage our finances, offering convenience and control over our banking transactions. North East Small Finance Bank (NESFB) provides an intuitive and secure net banking interface, making it easier for users to navigate and perform a variety of banking tasks. In this guide, we will explore the key features and functionalities of the NESFB net banking interface, ensuring you can make the most of your digital banking experience.

Getting Started with NESFB Net Banking

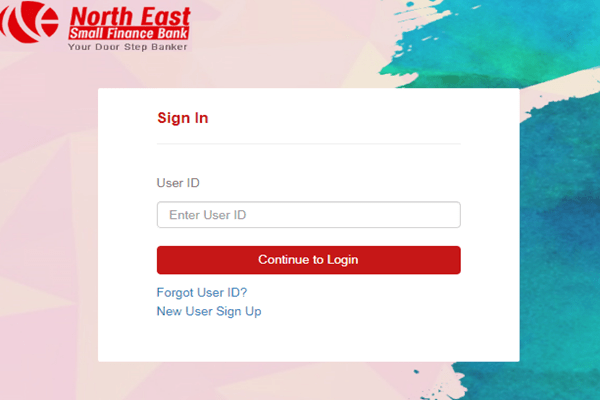

Before diving into the specifics, it’s important to understand how to access NESFB’s net banking service. Typically, you would need to:

- Visit the NESFB Website: Go to the official NESFB website and find the net banking portal.

- Login Credentials: Use your assigned username and password to log in. First-time users will have to go through a registration process.

Navigating the Dashboard

Once logged in, you’ll be greeted by the dashboard. This is the central hub where you can access various features and get a quick overview of your account.

- Account Summary: View balances and recent transactions of your savings, current, or loan accounts.

- Quick Links: Commonly used features like fund transfer, bill payment, or account statements are often accessible right from the dashboard for easy access.

Understanding the Menu and Options

The NESFB net banking interface typically includes a main menu, often located at the top or side of the page. This menu categorizes banking services into logical groups. For example:

- Accounts: Details of your accounts, mini statements, and account statement downloads.

- Transfer: Options for funds transfer within NESFB or to other banks, including NEFT, RTGS, and IMPS.

- Payments: Utility bill payments, credit card payments, and more.

- Services: Requests for cheque book, stop cheque payment, and other banking services.

Conducting Transactions

One of the primary uses of net banking is conducting transactions. NESFB’s interface simplifies this process.

- Transferring Funds: Choose the type of transfer, add beneficiary details (if not already done), enter the amount, and authorize the transaction.

- Paying Bills: Select the biller, enter the details of the payment, and confirm the transaction.

Personalizing Your Experience

Many net banking interfaces allow you to personalize your experience for greater convenience.

- Customization: Arrange widgets or shortcuts on your dashboard according to your preference.

- Alerts Setup: Set up SMS or email alerts for transactions, low balance, or other significant account activities.

Online Transactions with NESFB Net Banking

Online transactions are a cornerstone of NESFB’s net banking services. They provide convenience and efficiency, enabling customers to manage their finances remotely.

Types of Transactions Available

- Fund Transfers: Includes NEFT, RTGS, and IMPS.

- Bill Payments: Pay utility bills, credit card bills, and more.

- Online Shopping: Make secure payments for online purchases.

Setting Up Beneficiaries

For fund transfers, users need to set up beneficiaries. This process involves adding the recipient’s account details and verifying them for secure transactions.

Account Management and Services

NESFB’s net banking platform offers comprehensive account management services. Customers can monitor their accounts, update personal details, and request various banking services.

Overview of Account Management Features

The account management section in NESFB Net Banking is a centralized hub for all your account-related needs. Here’s what you can typically expect:

Viewing Account Details

- Account Summary: Get an instant overview of all your accounts, including savings, current, and loan accounts.

- Transaction History: Access detailed transaction histories to track your spending and deposits.

Managing Account Information

- Update Personal Details: Change your address, phone number, or email ID linked to your account.

- Nominee Management: Add or modify nominee details for your accounts.

Account Statements and Documentation

Accessing and managing your account statements is a key feature of NESFB Net Banking.

- E-Statements: Download or view your account statements for a chosen period.

- Account Certification: Request account-related certificates like interest certificates, balance certificates, etc.

Cheque Book Management

Cheque book management is an integral part of account services.

- Request New Cheque Book: Easily order a new cheque book through the net banking portal.

- Track Cheque Status: Check the status of issued cheques, including those cleared, pending, or stopped.

Linking and Managing Multiple Accounts

If you have multiple accounts with NESFB, net banking allows you to link and manage them under a single login.

- Link Accounts: Consolidate your savings, current, and loan accounts for easier management.

- Set Primary Account: Choose a primary account for default transactions.

Customizing Account Settings

Personalize your net banking experience to suit your preferences and banking habits.

- Transaction Limits: Set daily transaction limits for transfers and payments.

- Alert Preferences: Customize alerts for transactions, balance thresholds, and other important account activities.

Secure Account Operations

Security is paramount in online banking. NESFB provides robust security features to protect your account.

- Password Management: Change your net banking password regularly for enhanced security.

- Two-Factor Authentication: For certain transactions, additional authentication may be required for added safety.

Service Requests and Assistance

Apart from regular account management, NESFB Net Banking offers various service requests.

- Stop Payment Requests: Issue instructions to stop payment on a cheque.

- Report Lost/Stolen Card: Quickly report a lost or stolen debit/credit card.

- Customer Support: Access to customer support for any account-related queries or issues.

FD and RD Account Management

For those who have fixed deposit (FD) or recurring deposit (RD) accounts, NESFB Net Banking offers:

- Opening New FD/RD: Start a new fixed or recurring deposit online.

- Viewing FD/RD Details: Check details, maturity dates, and interest earned.

Customer Support and Assistance

NESFB provides robust customer support for net banking users. Assistance is available for technical issues, transaction queries, and general information.

Accessing Customer Support

- Helpline numbers and email support.

- Frequently Asked Questions (FAQ) section on the website.

Troubleshooting Common Issues

Guidance is available for common issues like login problems, transaction failures, and service unavailability.

Advanced Features in NESFB Net Banking

Customizing Your Banking Experience

NESFB’s net banking platform offers various customization options to enhance user experience. Customers can personalize their dashboard, set transaction limits, and manage alerts.

Scheduled Transactions and Recurring Payments

Users can schedule future transactions and set up recurring payments for loans, bills, and other regular expenses.

Online Investment and Loan Services

Exploring Investment Options

- Fixed Deposits: Easy creation and management of FD accounts.

- Recurring Deposits: Set up and track RD accounts.

Loan Management

- Loan Account Overview: View loan balances and transaction history.

- EMI Payments: Pay EMIs online with ease.

Safe and Secure Banking

Advanced Security Features

- Two-Factor Authentication: Enhances account security.

- Real-Time Alerts: Receive notifications for account activities.

Tips for Safe Online Banking

- Regularly change passwords.

- Avoid sharing login credentials.

- Use secure networks for transactions.

Enhancing Your Net Banking Experience

- Customizing Alerts and Notifications: Set up alerts for account activities, payment reminders, and promotional offers.

- Integrating with Mobile Banking: Link NESFB’s net banking with the mobile banking app for seamless financial management.

Frequently Asked Questions (FAQs)

Q1: How do I reset my net banking password?

A: Follow the ‘Forgot Password’ link on the login page and verify your identity to reset the password.

Q2: Can I open a new account through net banking?

A: Yes, you can apply for new accounts and services through the net banking portal.

Q3: Are there transaction limits on net banking?

A: Yes, transaction limits are in place for different services, which can be viewed under the account settings.

Q4: How do I contact customer support for net banking issues?

A: Customer support can be reached through the helpline, email, or by visiting a local branch.

Conclusion

NESFB’s net banking service stands out as a robust, user-friendly, and secure platform, offering a wide range of features to cater to the evolving needs of its customers. From basic account management to advanced investment and loan services, NESFB is committed to providing a seamless banking experience. Always prioritize security while enjoying the convenience of digital banking, and reach out to customer support for any assistance. Embrace the future of banking with NESFB’s net banking services.