How to Raise Capital For Your Small Business

You’ve worked hard for other companies for years and gotten back very little other than your paycheck. That’s why you decided to start your own business and become your own boss!

Small businesses are the backbone of the economy in the United States. A 2019 survey found about 30.7 million small businesses registered in the US!

But, starting a business costs a ton of money in most cases. How can you raise capital so you can live your dream of starting a business? Keep reading to learn our favorite tips to help you gather the funds you need.

Self-Financed Funding

One of the slowest ways to gain capital is to save up the money yourself. This can take a long time if you don’t have a bunch of expendable money in your budget. But, self-funding means you won’t start your business with a bunch of debt!

Angel Investors

An angel investor is someone who has plenty of wealth and wants to invest some of their money into getting a small business like yours off the ground. Many angel investors take risks on companies who don’t have enough credit with the banks to get traditional funding.

If you have an angel investor interested in your business, focus on your vision and business planning to assure them you’ll see success. Think of it as selling yourself as an entrepreneur to the investor.

Raise Capital With Crowdfunding Sites

Many small business owners use websites to ask the general public to donate money to help get a business off the ground. One way to encourage people to donate is to offer discounts on the products to anyone who donates with the amount of the discount going up as the amount of the donation gets bigger.

Small Business Loan

In the United States, most banks have a few options for small business loans to help get entrepreneurs the boost they need to get started. Make sure you understand the difference between the term lengths of the loans and how that affects your business.

Venture Capital

There are business groups that offer capital to small businesses in exchange for an agreed-on percentage of equity in the business. These guys want to make a profit on the companies they invest in, so they don’t often take risks on businesses with no financial history.

Every Big Business Started Small At Some Point

Before you set your funding goal, make sure to calculate the amount you would need to run the business and pay your own bills for at least a couple of years. It can take a while for a business to start seeing profits.

Whenever the little stressors of starting a business get you feeling down, remember that every business started small at some point. If you plan your business well, then you’ll have much better chances of success. We hope you enjoyed reading this article and that you learned about how to raise capital for your small business. If you’re looking for more helpful articles about business, finance, networking, and much more, check out the rest of our blog today!

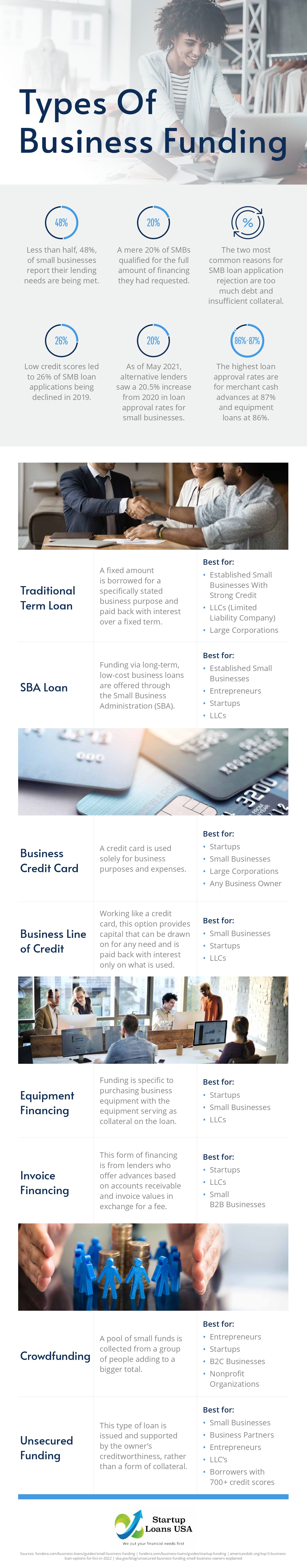

Infographic provided by Startup Loans USA, a business startup loans company